Ahead of the game: June 5, 2023

Your weekly financial calendar for market insights and key economic indicators.

ENDING MAY ON A SUBDUED NOTE, US EQUITY INDICES witnessed some profit-taking in the leading tech players, slightly dulling an otherwise impressive month. In May, the Nasdaq rose 7.61%, the S&P 500 added 0.25%, and the Dow Jones shed 3.49%.

The burgeoning allure of AI-related stocks is predicted to keep steering the Nasdaq in the foreseeable future, given AI technology's nascent stage of development and promising prospects. Any pullbacks in the Nasdaq and AI-centric shares will likely attract buyers, ready to capitalise on the next surge.

Even amidst a series of sturdy US economic data, this week's dovish overtures from Fed speakers have stirred market expectations of a potential Fed pause in the upcoming June FOMC meeting. In the words of Philadelphia Fed President Patrick Harker, “I think we can take a bit of a skip for a meeting.”

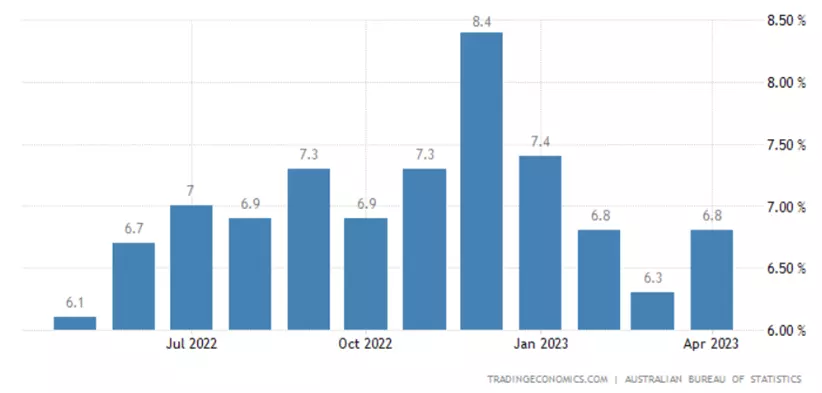

The ASX 200 dived to a three-month low on Wednesday following the left-right combination of a stronger-than-expected monthly Australian CPI print (6.8% vs 6.4% expected) and a weaker-than-expected China Manufacturing PMI print (48.8 vs 49.4 expected).

Looking ahead, the focus shifts to the RBA interest rate meeting, Australian Q1 GDP, and the US ISM services PMI.

- US President Joe Biden and House Speaker Kevin McCarthy agreed on a tentative deal to lift the debt ceiling, which the House passed. It now goes to the Senate

- Market predictions for a 25bp rate hike at the upcoming RBA meeting jumped from nearly zero to 25%

- Dovish Fed Speak from Jefferson, Mester and Harker saw pricing for a 25 bp hike at the June FOMC meeting ease from 66% to 26%

- The US 10-year bond yield dropped 25bp to 3.60%, as the debt ceiling deal sparked a significant rates unwind

- Nasdaq gained 7.61% in May, driven by AI-related stocks; S&P 500 rose 0.25% while Dow Jones lost 3.49%

- US JOLTS report showed a three-month high in job openings at 10.1 million vs 9.2 million expected

- US consumer confidence in May exceeded expectations at 102.3 vs 99

- Australia's Monthly CPI indicator for April showed a high of 6.8% vs 6.4% expected

- ASX 200 hit a three-month low in May with a 2.98% loss

- German inflation in May was unexpectedly low at 6.1% YoY, down from 7.1% in April

- China's Manufacturing PMI for May was lower than expected at 48.8 vs 49.4

- Crude oil dipped 6% before rebounding in anticipation of next week’s OPEC meeting

- Gold rose 1.5% to $1975, breaking a four-week losing streak

- The Wall Street Volatility (VIX) index fell 12.82% to 15.64, indicating less market fear.

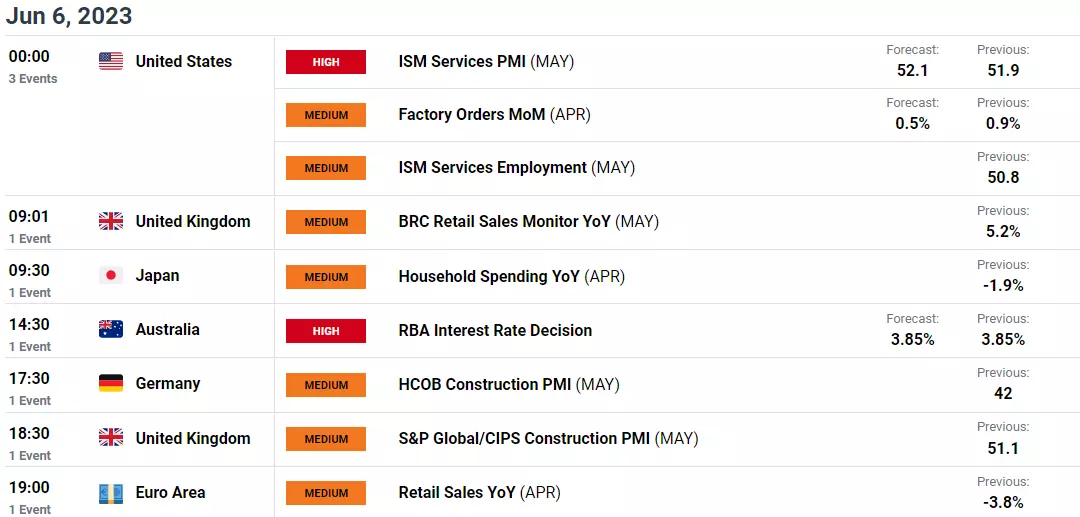

- AU: RBA Interest Rate Decision (Tuesday, June 6 at 2:30 pm AEST)

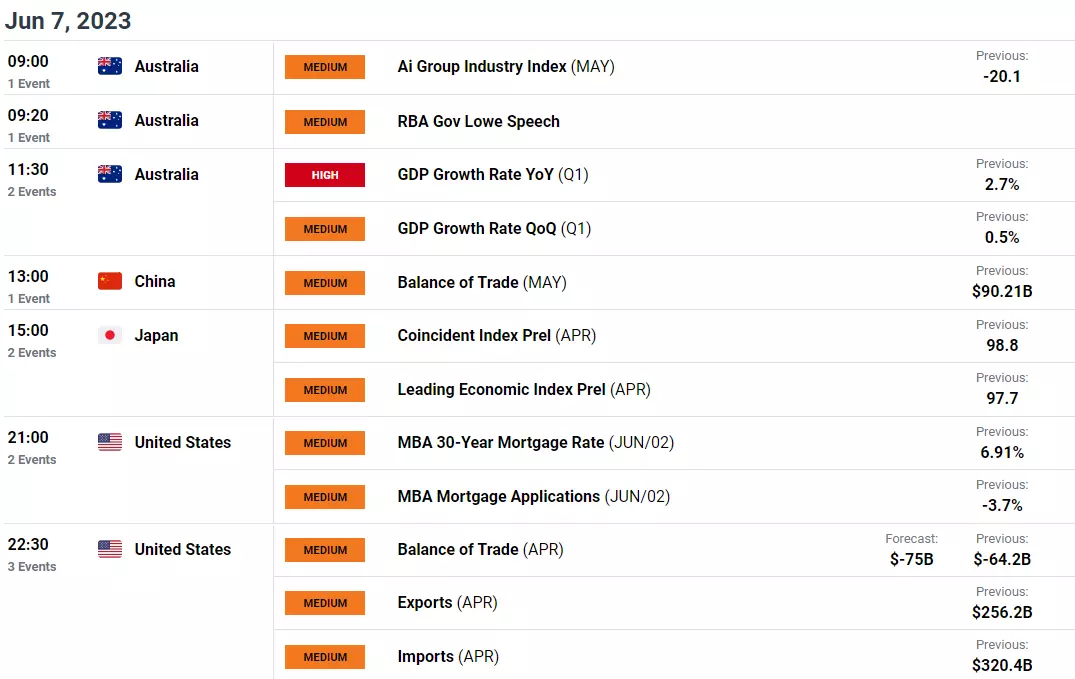

- AU: RBA Governor Lowe Speech (Wednesday, June 7 at 9:20 am AEST)

- AU: Q1 GDP (Wednesday, June 7 at 11:30 am AEST)

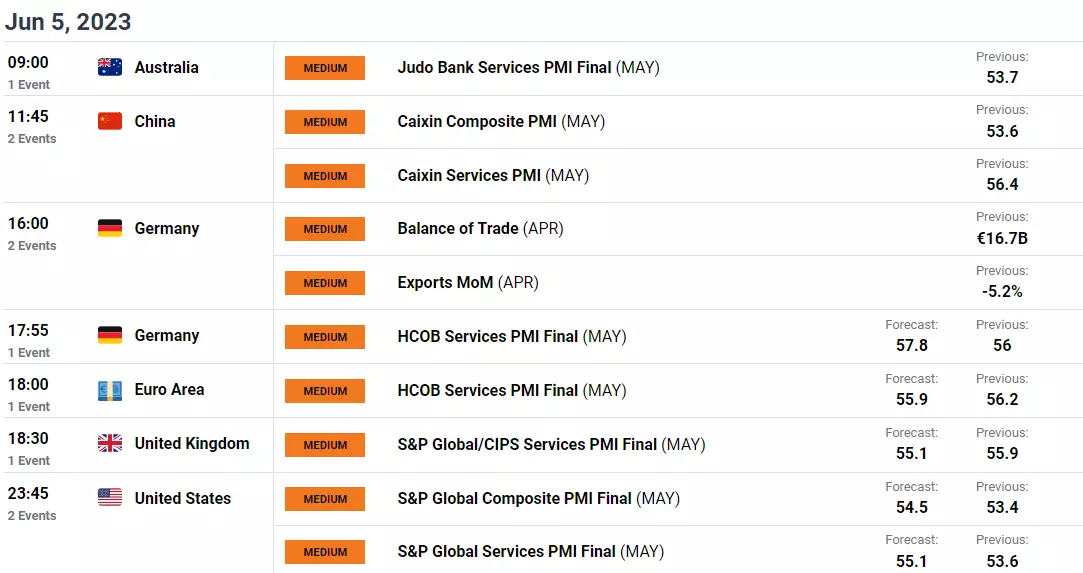

- CN: Caixin Services PMI (Monday, June 5 at 11:45 am AEST)

- CN: Balance of Trade, Exports, and Imports (Wednesday, June 7 at 1:00 pm AEST)

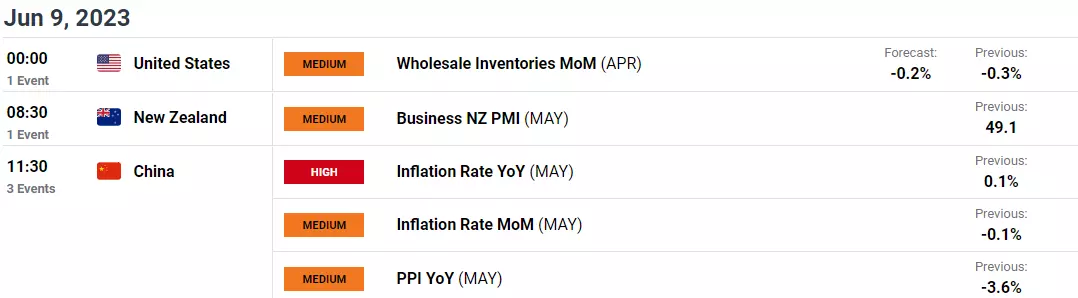

- CN: CPI and PPI (Friday, June 9 at 11:30 am AEST)

- US: ISM Services PMI (Tuesday, June 6 at 12:00 am AEST)

- US: Factory Orders (Tuesday, June 6 at 12:00 am AEST)

- US: Balance of Trade (Wednesday, June 7 at 10:30 pm AEST)

- GE: Factory Orders (Tuesday, June 6 at 4:00 pm AEST)

- EA: Retail Sales (Tuesday, June 6 at 7:00 pm AEST)

- GE: Industrial Production (Wednesday, June 7 at 4:00 pm AEST)

Break down

-

Australia

RBA interest rate meeting

Tuesday, June 6 at 2.30 pm AEST

Last month, the RBA surprised markets, hiking the cash rate by 25bp to 3.85% - its eleventh since last May, totalling 375bp. With inflation potentially peaking yet still high, another increase was deemed necessary for target alignment.

"Considering the urgency of returning inflation to target, the board judged another interest rate increase appropriate."

The RBA maintains its tightening stance, with possible future hikes depending on economic and inflationary trends.

"The Board remains vigilant over global economic developments, household spending trends and inflation, and labour market forecasts."

Post-May RBA meeting, wages, employment, and retail data have underperformed. However, the Monthly CPI indicator exceeded expectations at 6.8%, and the core inflation measure rose to 6.7%.

This Monthly CPI surge might unsettle the RBA, which is seeking definitive signs of cooling inflation. Additionally, the Fair Work Commission's higher-than-anticipated wage increase in its Annual Review might factor into RBA's considerations.

With a hotter Monthly CPI and greater wage hike, we anticipate a further 25bp rate hike to 4.10% at the upcoming RBA meeting.

ABS monthly CPI indicator

-

Australia

Q1 2023 GDP

Thursday, June 1 at 7.00 pm AEST

In the December quarter (Q4) of 2022, Australia’s economic growth increased by 0.5% QoQ or 2.7%YoY deceleration from 5.9%YoY in the September quarter.

In Q1 of 2023, the market’s preliminary forecast is for GDP to increase by 0.4%QoQ or 2.5%YoY. While this would represent a sixth consecutive quarter of economic expansion, it would be the slowest pace since the 2% fall in the September quarter of 2021.

As outlined in the Statement of Monetary Policy in May, the RBA expects growth to continue to slow as it seeks to tame inflation and cool the labour market via higher interest rates.

“Over the period ahead, GDP growth is expected to be below trend. It is expected to trough at around 1¼ per cent and then to pick up gradually to 2 per cent by mid-2025 as the drag from higher inflation and interest rates wanes and household wealth recovers.”

Australia GDP quarterly growth rate chart

-

US

ISM Services PMI

Tuesday, June 06 at 12.00 am AEST

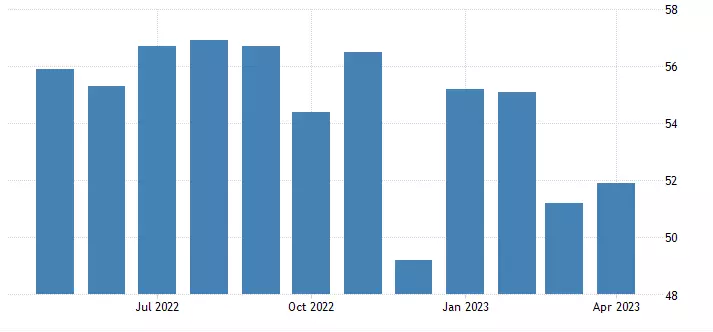

The ISM services PMI and inflation data the following week are the two last major data releases before the June FOMC meeting on June 15.

The ISM services PMI increased to 51.9 in April from 51.2 in March, again highlighting the divergence between soggy manufacturing PMI and robust services PMIs. Behind the solid number is an increase in new orders (56.1 vs 52.2) and in new export orders (60.9 vs 43.7).

This month the market is looking for service PMI to increase to 52.5 or a fifth consecutive month of growth in the services sector.

US services PMI chart

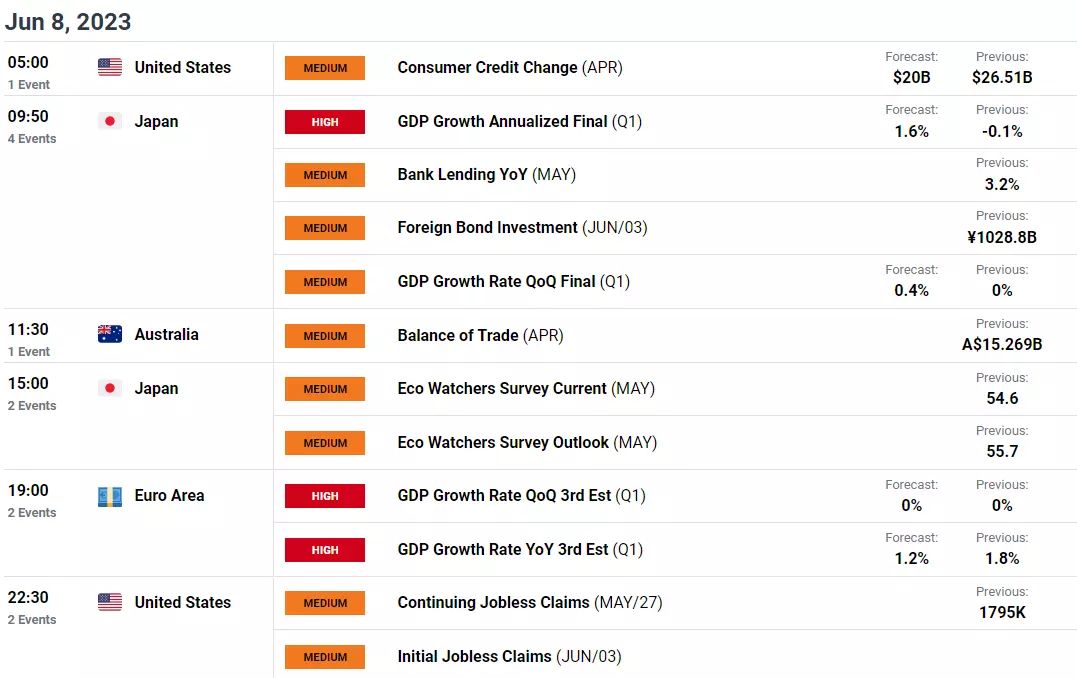

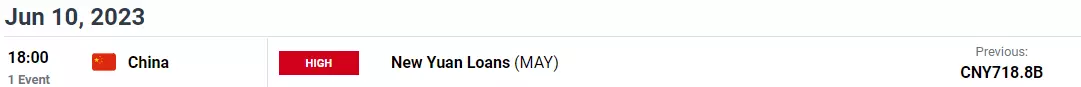

Economics calendar

All times shown in AEST (UTC+10) unless otherwise stated

This information has been prepared by IG, a trading name of IG Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

CFDs are a leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your initial deposit, so please ensure that you fully understand the risks involved.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.